Your Guide to SaaS Customer Acquisition Cost

Oct 19, 2025

Let's think about your SaaS Customer Acquisition Cost (CAC) like a car's MPG rating. It tells you exactly how much fuel—in this case, sales and marketing dollars—you have to burn to get one new customer to sign up. If you want to build a SaaS company that can actually scale and turn a profit, getting a handle on this number isn't just important; it's everything.

Why CAC Is the Lifeblood of a SaaS Business

When you sell a physical product, a single transaction usually covers the cost of making that sale right away. But SaaS is a different game entirely. You spend money upfront to win over a new user, and you have to earn that investment back piece by piece, month after month, over the life of their subscription.

This delayed payback is what makes understanding your saas customer acquisition cost so damn critical. It’s not just another line item on a P&L statement; it's a direct investment in your future revenue stream. Spend too much to land a customer, and you could be in the red on that account forever. On the flip side, if you're too conservative with your spending, you might be leaving a ton of growth on the table.

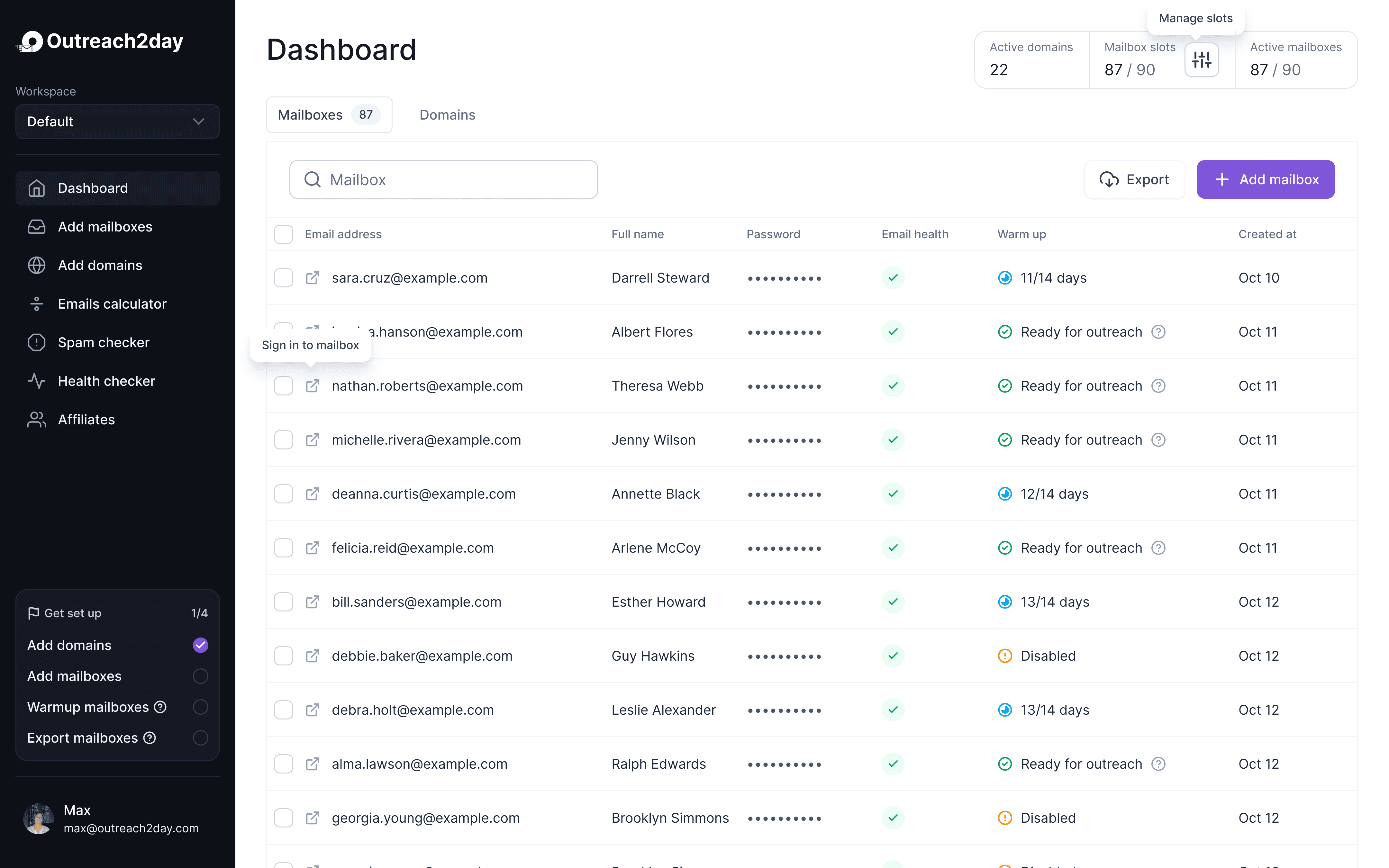

This infographic really drives home how tracking metrics like CAC is like having a dashboard for your business—it gives you the data you need to see how "fuel-efficient" your growth engine truly is.

The point here is that measuring CAC isn’t just about number-crunching. It's about having the clarity to make smart decisions that steer your company toward real, sustainable growth.

The Core Relationship: CAC and LTV

You can't really understand the power of CAC until you look at it alongside its partner in crime: Customer Lifetime Value (LTV). LTV is the total amount of money you can reasonably expect to make from a customer over the entire time they stick with you.

The magic happens in the relationship between what you spend to get them (CAC) and what you earn from them (LTV). This is the core economic equation of any successful SaaS business. For your model to work, the value a customer brings in has to be way higher than what it cost you to get them through the door.

Key Takeaway: Think of it this way: CAC is what you pay, and LTV is what you get. A healthy SaaS business makes sure the "get" is a lot bigger than the "pay."

This dynamic duo basically determines your company's financial health and its potential to scale. A high CAC might look scary at first glance, but if those expensive customers have a massive LTV, it's actually a fantastic investment. In this guide, we'll break down how to calculate, benchmark, and fine-tune your CAC to nail this balance and build a truly powerful growth engine.

How to Calculate Your SaaS CAC Correctly

Figuring out your SaaS customer acquisition cost isn't just a chore for the finance team—it's the single most important health check for your growth engine. Get this number right, and you can confidently steer your budget and strategy. Get it wrong, and you might be driving full speed toward a cliff of unprofitable growth.

At its core, the math is refreshingly simple. It all comes down to one question: How much did you spend, and how many new customers did that money actually bring through the door?

The Essential CAC Formula: Total Sales & Marketing Spend ÷ Number of New Customers Acquired = Customer Acquisition Cost (CAC)

This formula is your starting point, but its accuracy hangs entirely on what you stuff into that "Total Spend" number. The most common mistake founders make is only counting their direct ad spend, which paints a dangerously optimistic (and wrong) picture of their CAC.

What to Include in Your Total Spend

To get a true, fully-loaded CAC, you need to be honest with yourself and account for every single dollar that helps bring in new customers. This means looking way beyond your ad campaigns and including all the operational costs that keep the machine running.

To make sure you're getting an accurate number, you need to track a wide range of expenses.

Expense Category | Examples |

|---|---|

People Costs | Salaries for your entire sales and marketing teams, plus commissions and performance bonuses. |

Paid Channels | The obvious one: all money spent on PPC, social media ads, sponsorships, and paid content. |

Software & Tools | Every subscription your teams use to find and win customers—think HubSpot, Salesforce, Ahrefs, etc. |

Creative & Content | Costs for freelance writers, designers, video production, or any third-party content creation. |

Overhead | A reasonable portion of general business costs like office rent, utilities, or team events. |

Sweeping these costs under the rug gives you a misleadingly low CAC, creating a massive blind spot in your financial model.

A Practical Calculation Example

Let's put this into action with a hypothetical SaaS startup we'll call "SyncUp." We'll calculate their CAC for the first quarter (Q1).

SyncUp's Q1 Expenses:

Sales & Marketing Team Salaries: $75,000

Sales Commissions: $15,000

Google & LinkedIn Ad Spend: $25,000

Marketing & Sales Software Tools: $5,000

Content Freelancers: $3,000

First, we tally it all up to get the total spend. $75,000 + $15,000 + $25,000 + $5,000 + $3,000 = $123,000

In that same quarter, the SyncUp team successfully acquired 250 brand new paying customers.

Now, we just plug the numbers into our formula: $123,000 ÷ 250 New Customers = $492 CAC

Boom. SyncUp now knows it cost them $492 to acquire each new customer in Q1. This isn't just a random number; it's a powerful benchmark. For context, recent data shows the average B2B SaaS company globally spends around $536 to get a new customer. Knowing their CAC is $492 gives SyncUp a clear signal that their acquisition engine is running pretty efficiently compared to the wider market. If you're curious, you can dig into more data on average customer acquisition costs to see how various channels stack up.

With this clear, fully-loaded SaaS customer acquisition cost, the SyncUp team can now make smarter decisions. They can analyze the profitability of their marketing channels, set realistic growth targets for Q2, and, most importantly, confirm that their pricing and customer lifetime value can actually support this level of investment.

What Is a Good SaaS CAC Benchmark?

So you've calculated your SaaS customer acquisition cost. You have a number. Now what?

Is a $500 CAC a sign of incredible efficiency or a five-alarm fire? The only honest answer is: it depends. A "good" CAC isn't some magic number you pull from a report. It’s all about context—the context of your industry, your market, and most critically, your own business model.

The first sanity check is to see how you stack up against the competition. Comparing your CAC to industry benchmarks tells you if you're even in the right ballpark. Unsurprisingly, the cost to land a new customer swings wildly depending on who you're selling to.

Just look at the gap. For enterprise SaaS, the costs can be eye-watering, ranging from $2,190 in eCommerce SaaS to a jaw-dropping $14,772 in fintech. That's what it takes to navigate long sales cycles, intense compliance hurdles, and enterprise-level decision-making.

On the other hand, SaaS companies selling to small and medium businesses (SMBs) live in a different world, with CACs usually falling between $300 to $900. If you want to dig deeper into the numbers, you can check out more 2025 benchmarks.

The Real Measures of a Good CAC

But industry averages only tell you part of the story. The true health of your acquisition strategy is measured by two metrics that tie your spending directly to value: the LTV to CAC ratio and the CAC Payback Period.

These are the numbers that really matter. They shift the conversation from "How much did we spend?" to "Was it a good investment?"

LTV to CAC Ratio: Think of this as the ultimate health score for your business. It pits the lifetime value of a customer against what you paid to get them in the door.

CAC Payback Period: This one is simple: how many months does it take to earn back the money you spent to acquire a customer?

The Gold Standard LTV to CAC Ratio

For a SaaS business to be healthy and scalable, the accepted gold standard for the LTV to CAC ratio is 3:1.

In plain English, this means for every $1 you spend on customer acquisition, you should expect to get at least $3 back over that customer's lifetime. A 3:1 ratio is the sign of a well-oiled machine that's acquiring profitable customers.

If your ratio is way off this benchmark, it’s time to look under the hood.

A Ratio Below 3:1 (like 1:1 or 2:1): This is a serious red flag. You're spending too much for what you're getting back. At best you're breaking even; at worst, you're losing money on every new customer. That's a surefire way to burn through your cash.

A Ratio Well Above 3:1 (like 5:1 or higher): This might sound great, but it often means you’re being too timid. A super high ratio can signal that you're underinvesting in sales and marketing, leaving a huge chunk of the market for your competitors to scoop up.

Understanding Your CAC Payback Period

The second piece of the puzzle is your CAC Payback Period. It’s all about speed. How fast do you get your money back?

For most venture-backed SaaS companies, the goal is a payback period of under 12 months.

Why? Because a shorter payback period means you recoup your investment faster, freeing up that cash to pour right back into acquiring the next wave of customers. It's the engine of a self-sustaining growth loop. A long payback period of 18 or 24 months, however, can seriously strain your cash flow and slam the brakes on your ability to scale.

Ultimately, a "good" SaaS customer acquisition cost isn't a static number. It's a dynamic one that works for your business, proven by a healthy LTV to CAC ratio and a quick payback period.

Key Factors That Drive Your Acquisition Costs

Ever look at a competitor and wonder how their saas customer acquisition cost is just a fraction of yours, even when you’re in the same space? It’s not just luck. CAC isn't some fixed number handed down from the heavens; it's a living, breathing metric shaped by dozens of decisions you make about your business.

Getting a handle on these drivers is the first real step toward wrestling your costs down.

Some of these factors are just baked into your business model from day one. Others are tied to how you go to market. Think of it like tuning an engine. You can't really change the engine block itself (your core product and market), but you can absolutely adjust the fuel mix, timing, and airflow (your strategies) to squeeze out way more performance.

Let's pull back the curtain on what really moves the needle on your acquisition costs.

Your Target Market and ACV

The single biggest factor dictating your CAC? It’s almost always who you sell to. The effort and cash needed to land a small business paying $50/month is on a completely different planet from what it takes to close a $100,000 annual contract value (ACV) enterprise deal.

A high-ACV, enterprise-focused model just comes with a higher CAC. It has to. The whole process is built on a different foundation.

Marathon Sales Cycles: Enterprise deals don't close overnight. We're talking 6-18 months of demos, security reviews, legal back-and-forth, and charming a whole committee of stakeholders.

High-Touch Sales Teams: You can't automate your way into a Fortune 500 company. It takes seasoned (and expensive) account executives who know how to navigate those complex political landscapes.

Complex Demands: Big clients want custom everything—integrations, features, dedicated support. All that pre-sale work adds up.

On the flip side, a low-ACV model targeting SMBs or individuals is all about volume and efficiency. The goal is a smooth, automated buying experience where a customer can sign up and pay without ever talking to a human. That's how you keep CAC low.

Sales Motion and Pricing Model

How you actually go about selling your product—your sales motion—is welded to your target market, and it has a massive impact on your spending. A company running on product-led growth (PLG) with a freemium or free trial model will almost always have a lower CAC than a traditional, sales-led organization.

The magic of the PLG model is that it turns the product into its own best salesperson. Users get to see the value for themselves before a sales rep ever enters the picture. This does a huge amount of the qualification work for you and dramatically shortens the sales cycle.

This approach means you don't need a huge army of reps cold calling prospects. The product does the heavy lifting, freeing up your sales team to focus on converting users who are already bought in and waving their hands to talk. If you want to go deeper, our guide on B2B lead generation techniques breaks down how different strategies fill your pipeline.

Market Competitiveness and Brand Strength

Finally, you can't ignore the world outside your walls. If you’re fighting for customers in a "red ocean" market, you’re going to have to spend more just to get noticed. Try bidding on Google Ads for a term like "project management software." It's a bloodbath, and it's incredibly expensive because everyone is shouting for the same person's attention.

This is where a strong brand becomes your secret weapon for keeping your saas customer acquisition cost in check. A name people know and trust gets you:

More Organic Traffic: People start searching for you by name, not just for a generic solution.

Word-of-Mouth Marketing: Happy customers turn into a volunteer sales force.

Sky-High Conversion Rates: Trust is the ultimate conversion lubricant. It just makes it easier for prospects to pull the trigger.

Building a brand is a long game, for sure. But it pays off by creating a moat around your business that makes every single dollar you spend on acquisition work harder.

Actionable Strategies to Reduce Your SaaS CAC

Knowing your SaaS customer acquisition cost is just the start. The real magic happens when you start actively pushing that number down. This isn't about gutting your budget; it’s about making every dollar you spend work smarter, not just harder.

Getting a handle on CAC is more critical than ever. In 2024, the median new CAC ratio for SaaS companies hit $2.00. That means for every dollar of new annual recurring revenue, companies are spending two to get it. That’s a sobering 14% jump from previous years.

The gap is widening, too. The least efficient companies are now spending nearly three times what top performers spend to acquire the same revenue. You can find more details on the growing CAC efficiency gap.

So, let's dive into the proven strategies that directly attack this problem.

Optimize Your Marketing and Funnel Efficiency

Your marketing funnel is the first battleground for customer acquisition. Even tiny improvements here can create massive downstream effects on your CAC. The game is to stop wasting cash on tire-kickers and get more out of the prospects who are already knocking on your door.

This all begins with Conversion Rate Optimization (CRO). Think of CRO as the science of getting more website visitors to take the action you want. It involves a continuous process of testing things like your landing page headlines, button colors, and signup forms to find what truly clicks with your audience.

Next, you need to go all-in on SEO and content marketing. Paid ads get you quick traffic, sure, but they vanish the moment you stop paying. Content and SEO? They’re assets that grow in value over time, paying dividends for months and years.

Solve Real Problems: Don't just blog. Create in-depth guides, practical case studies, and articles that directly solve your ideal customer's biggest headaches.

Hunt for High-Intent Keywords: Go after long-tail keywords like "best accounting software for freelancers." These phrases attract people who are past the research phase and are ready to buy.

Build Your Authority: When other reputable sites link to your content, it’s a huge vote of confidence for search engines. This boosts your rankings and brings in a steady stream of free, organic traffic.

And finally, you have to be absolutely ruthless with your paid ad campaigns. Stop spraying and praying. Get granular with audience segmentation, use negative keywords to weed out irrelevant clicks, and A/B test your ad copy until you can't test it anymore. A finely-tuned campaign delivers higher-quality leads, which means your sales team isn't wasting time on dead ends.

Streamline Your Sales Process

A clunky, inefficient sales process is a silent CAC killer. It inflates your costs by burning through your most precious resource: your sales team's time. The longer your sales cycle drags on, the more each new customer costs you.

Your first move is to nail your lead qualification process. Let's be honest, not all leads are created equal. By implementing a lead scoring system, you can automatically flag the prospects who are most likely to convert. This lets your reps focus their energy where it counts instead of chasing ghosts.

This focus is crucial. When your sales team spends 80% of their time talking to the top 20% of qualified leads, their close rates—and your overall acquisition efficiency—will skyrocket.

Automation is your other secret weapon here. Think about all the tedious tasks that eat up the day: data entry, scheduling follow-ups, sending that first outreach email. All of it can be automated. For example, you can learn how to send hundreds of personalized cold emails a month with automation and save countless hours. This frees up your reps to do what humans do best: build relationships and close deals.

Embrace Product-Led Growth Strategies

What if your product could sell itself? That’s the core idea behind Product-Led Growth (PLG), and it's probably the most powerful way to slash your CAC. It’s a strategy where the product itself becomes the main driver of acquisition, activation, and expansion.

Here are a few of the most popular PLG plays:

Freemium Models: Offer a free-forever version of your product. This lets users experience its value firsthand with zero friction and zero cost to you. It builds a massive pipeline of product-qualified leads who already know and like your tool.

Free Trials: A time-limited trial achieves a similar goal but adds a sense of urgency. During the trial, you can use automated onboarding sequences to guide users to that "aha!" moment, dramatically increasing the odds they'll pull out their credit card.

Referral Programs: Why not turn your happiest customers into your best salespeople? Rewarding users for inviting their friends and colleagues can create a viral growth loop. This brings in a steady stream of high-quality customers for a tiny fraction of what traditional marketing costs. Just look at Dropbox—they grew an unbelievable 3900% in 15 months with their simple "get more free space" referral program.

Each of these strategies plays a different role in bringing down your CAC. To help you decide where to focus, here’s a quick breakdown of their impact and how long they typically take to implement.

CAC Reduction Strategies Comparison

Strategy | Primary Impact Area | Typical Timeline |

|---|---|---|

Conversion Rate Optimization (CRO) | Marketing Funnel | Short-term (weeks to months) |

SEO & Content Marketing | Marketing Funnel | Long-term (6+ months) |

Paid Ad Refinement | Marketing Funnel | Short-term (weeks to months) |

Lead Scoring & Qualification | Sales Process | Medium-term (1-3 months) |

Sales Automation | Sales Process | Short-term (weeks) |

Freemium/Free Trial Models | Product-Led Growth | Long-term (requires product changes) |

Referral Programs | Product-Led Growth | Medium-term (1-3 months) |

As you can see, some tactics like ad refinement offer quick wins, while others like SEO are a long-term investment. The most successful SaaS companies use a blend of these strategies, constantly optimizing their funnel, sales motion, and product to create a truly efficient growth engine.

Balancing CAC with Lifetime Value for Long-Term Growth

Chasing the lowest possible saas customer acquisition cost is a fool's errand. The real goal? Building a profitable, sustainable growth engine. And the true test of your acquisition strategy isn't just what you spend, but how it stacks up against Customer Lifetime Value (LTV).

Looking at CAC in a vacuum is like buying a car based only on the sticker price. It tells you nothing about the gas mileage, maintenance costs, or how long it will last. You might save a few bucks upfront, but it could cost you a fortune down the road.

A slightly higher CAC can be an incredible investment if it lands you a customer with a much higher LTV. Think about it:

Segment A: Costs $300 to acquire. They stick around for a year and generate $600 in revenue.

Segment B: Costs $500 to acquire. But these customers are lifers, staying for five years and generating $3000.

Which would you choose? The higher CAC for Segment B is a no-brainer. It's the smarter, more profitable play every single time. This completely shifts your focus from just cutting costs to creating real, lasting value. You stop chasing cheap leads and start acquiring long-term partners.

Investing Beyond Acquisition

Now, things like customer support and product development aren't technically part of the CAC formula. But they are absolutely critical for maximizing LTV and making your acquisition spend worthwhile.

You can have the best sales and marketing team in the world, but if the product is clunky and support is nonexistent, those new customers will be gone in a flash. A stellar product with fantastic support is what turns that first sale into years of loyalty. These are the investments that ensure the money you spend on acquisition pays you back over and over again.

Key Takeaway: CAC is one half of the most important equation in your SaaS business. A healthy company doesn't just manage its acquisition costs; it strategically invests in customer success to ensure the value of those customers far exceeds their initial cost.

This balance is the bedrock of a scalable business. When you understand the costs involved in different growth strategies, you can make much smarter decisions. For instance, digging into the pricing for various outreach tools gives you a clear picture of how your budget choices directly affect your ability to scale up your acquisition efforts.

Tying It All Together

We've covered a lot on how to calculate, benchmark, and lower your acquisition costs. But if you take away only one thing, let it be this: CAC is never a standalone metric. It's the cost side of a value equation, and its success is completely tied to the LTV it helps create.

At the end of the day, a healthy SaaS business runs on a simple principle: spend a dollar to get a customer, and make sure you get several dollars back over their lifetime. Mastering that delicate dance between what you spend and what you earn is the real secret to building a company that doesn't just grow, but actually lasts.

This mindset transforms your saas customer acquisition cost from a simple line item on a spreadsheet into a powerful investment in your company's future.

Common Questions About SaaS CAC

As you start getting a handle on your SaaS customer acquisition cost, you'll find a few key questions pop up again and again. Getting these sorted out is what turns CAC from a number on a spreadsheet into a tool you can actually use to make smarter calls.

Let's dive into some of the most common ones.

What Is a Good LTV to CAC Ratio?

If you're looking for the gold standard, a healthy SaaS business usually aims for an LTV to CAC ratio of 3:1.

It’s a simple but powerful benchmark. It means for every dollar you put into landing a new customer, you should eventually get three dollars back. This is the sweet spot that signals a sustainable, profitable growth engine.

But what happens when you're off the mark?

A 1:1 or 2:1 Ratio: This is a serious warning sign. You're basically breaking even (or close to it) on each customer, which leaves no room for profit. It’s a fast track to burning cash.

A 5:1 Ratio or Higher: This sounds great on the surface, but it's often a sign that you're playing it too safe. An extremely high ratio usually means you're not investing enough in sales and marketing, leaving a huge opportunity for your competitors to grab market share.

How Often Should I Calculate CAC?

The right answer really depends on what you're trying to achieve. For most SaaS companies, a two-pronged approach works best.

Calculate it monthly for tactical moves. This gives your marketing and sales teams a quick feedback loop to see if that new ad campaign or messaging is actually working. It lets them pivot fast. Calculate it quarterly for the big picture. This smooths out any monthly spikes or dips and gives you a more stable view for budgeting and long-term strategic planning.

How Does Inbound Marketing Lower CAC?

Inbound marketing—think content, SEO, and building an audience—is one of the most powerful ways to bring your acquisition costs down over the long run. It's a fundamentally different game than paid ads.

Here’s an easy way to think about it: Paid ads are like renting an audience. The second you stop paying, the leads dry up.

But a great blog post or a helpful guide is an asset you own. Once that piece of content starts ranking on Google, it can bring in a steady stream of high-quality, low-cost leads for months, or even years, to come. This ever-growing stream of organic traffic is what ultimately drives your average SaaS customer acquisition cost down.

Ready to scale your outreach without the technical headache? Outreach Today automates your entire email infrastructure, from domain setup to deliverability monitoring, so you can focus on growing your pipeline, not managing mailboxes. Learn more at https://outreach2day.com.

Setup your outreach in

3 minutes. Literally.

Add or transfer domains from other platforms, set up mailboxes, and initiate warming or export processes